Banner advertising works for fintech brands only when it is designed as a long-horizon trust and intent-shaping system, not as a short-term conversion channel. Fintech users are risk-aware, regulation-sensitive, and comparison-driven. They do not “click and convert” after one exposure.

The fintech brands that consistently get value from banner advertising follow three hard rules:

- Campaigns are structured by user intent maturity, not by product line alone

- Testing focuses on message credibility and risk reduction, not just colors and CTAs

- Budgets are allocated based on learning efficiency and signal quality, not CPMs or short-term ROAS

Everything else is noise.

Why Banner Advertising Behaves Differently in Fintech

Fintech is a high-friction category. When someone sees a fintech banner, the dominant emotion is not curiosity. It is a caution. The user is subconsciously asking whether the company is real, whether their funds or data are safe, whether the product is regulated, and whether there is any reason to trust this brand more than an existing bank or provider.

Those questions happen before interest and far before conversion. That is why banners rarely produce clean last-click conversions in fintech. Their value shows up later, indirectly, and across channels.

Banner exposure reduces uncertainty over time. It increases brand familiarity in financial contexts. It lowers resistance when the user later encounters the brand through search, referral, or word of mouth. When banner advertising is evaluated only on direct sign-ups, it will always look weak. When it is evaluated as supporting infrastructure, it starts to make economic sense.

Where Platforms Fit Into Fintech Banner Strategy

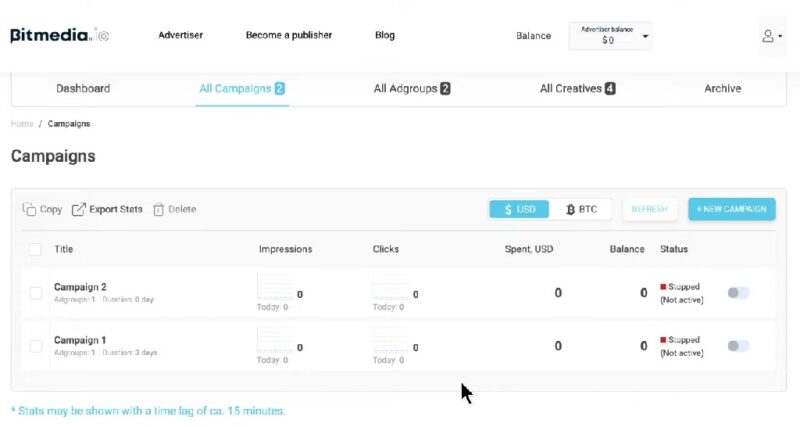

When fintech brands like Bitmedia expand beyond generic display networks, specialized platforms often play a role in reaching financially literate or investment-focused audiences.

For fintech products connected to crypto, trading, payments, or digital assets, Bitmedia functions as a contextual distribution layer rather than a pure performance channel. Its value lies in placing banner campaigns directly within environments where users already consume financial and crypto-related content. Used correctly, this supports the awareness and consideration layers by aligning brand exposure with high-intent financial contexts.

The key point is that platforms like this should not replace broader programmatic strategy. They should complement it, filling gaps where mainstream display inventory lacks contextual depth or audience relevance.

Campaign Structure: Building a Fintech Banner System That Holds Up

The three-layer structure that actually works

High-performing fintech banner programs are layered systems. Each layer serves a different psychological role and targets users at a different stage of readiness.

| Campaign layer | Primary role | Audience state | Main success indicator |

| Awareness | Establish legitimacy | Cold but context-relevant users | Reach consistency and frequency |

| Consideration | Frame the financial problem | In-market or comparison-aware users | Engagement depth |

| Conversion assist | Reduce hesitation | Warm and returning users | Assisted conversions |

Trying to collapse these layers into a single campaign usually results in confused messaging and unreliable performance data.

Awareness campaigns: legitimacy before persuasion

The awareness layer exists to answer a single question in the user’s mind: Is this a real financial company?

This is not the place for feature lists or aggressive claims. Trust comes from restraint. Targeting should prioritize contextual credibility rather than extreme behavioral precision. Finance news, investing content, business media, and reputable publishers matter more than micro-segmented interests.

Creative at this stage should be clean and factual. Clear brand naming matters. Calm visuals outperform flashy design. Overpromising tends to increase skepticism rather than interest.

Success here is measured through stable reach, controlled frequency, and consistent exposure in trusted environments. Click-through rate and CPA are poor indicators at this stage and should not drive decisions.

Consideration campaigns: problem framing over product pushing

The consideration layer is where banner advertising starts to earn attention instead of merely being seen. Users here are already thinking about a financial problem, even if they have not chosen a solution.

This is where many fintech brands make a critical mistake. They talk about what the product does instead of what the user is struggling with. Users do not engage with banners because of features. They engage because a message reflects a pain point they already recognize.

Effective consideration messaging frames issues such as hidden fees, slow transfers, lack of transparency, limited access, or outdated systems. The product is implied as an alternative, not forced as a solution.

Targeting becomes more selective at this stage. In-market signals, contextual placement near comparison content, and exposure within competitor ecosystems all perform well. However, over-segmentation often slows learning and should be avoided early on.

Engagement quality matters more than raw clicks. Longer sessions, repeat visits, and interaction with educational content are better indicators of success than immediate sign-ups.

Conversion assist campaigns: reassurance at the decision edge

Conversion assist campaigns focus on users who already know the brand. These users have visited the site, interacted with content, or started but not completed a signup flow.

The goal here is reassurance, not persuasion. Messaging should reduce fear and uncertainty. Security standards, regulatory alignment, customer scale, and clear explanations of how funds or data are handled become effective at this stage.

Tone matters more than urgency. Fintech users respond better to calm confirmation than to pressure. These campaigns rarely generate first-touch conversions, but they significantly improve completion rates elsewhere in the funnel.

Their performance should be evaluated primarily through assisted conversions and conversion rate lift in other channels, not last-click attribution.

Testing Strategy: What Fintech Teams Should Actually Test

Why most banner tests produce no insight

Many fintech banner tests fail because they focus on cosmetic changes. Small adjustments to color, button wording, or layout rarely change how safe or credible a financial product feels.

In fintech, performance differences are driven by message clarity and risk perception, not visual preference. If a test does not materially alter how the user evaluates downside risk, it is unlikely to generate useful learning.

The test dimensions that actually move the results

Meaningful fintech banner testing focuses on a small number of high-impact variables.

| Test dimension | What changes | Why it matters |

| Message framing | Cost control, access, safety, simplicity | Matches user motivation |

| Risk communication | Transparency vs reassurance | Builds trust without fear |

| Proof signals | Regulation, partners, and user scale | Reduces legitimacy doubts |

| CTA tone | Neutral vs directive | Aligns with caution levels |

Tests should isolate one of these dimensions at a time. Combining multiple changes in a single test usually contaminates results and slows learning.

Testing timelines and volume discipline

Fintech banner tests require patience. Signals emerge slowly because users do not act immediately. Cutting tests early almost always produces false conclusions.

Creative tests should run long enough to accumulate stable impression volume and repeat exposure. Engagement metrics should be monitored alongside conversions, especially in awareness and consideration layers. Learning velocity matters more than speed.

Budget Allocation Rules That Prevent Waste

Why CPM obsession damages fintech performance

Optimizing banner budgets purely toward low CPM inventory often results in poor attention quality. Cheap impressions frequently come from environments that users do not trust, which can actively harm brand perception.

In fintech, attention quality beats impression volume. Paying more for placements within trusted financial contexts often delivers better downstream performance, even if short-term metrics look weaker.

A stable budget distribution model

While exact numbers vary by maturity and product, effective fintech banner programs tend to follow a similar structure.

| Funnel layer | Typical budget share | Strategic role |

| Awareness | 40–50 percent | Long-term trust and memory |

| Consideration | 30–40 percent | Engagement and intent formation |

| Conversion assist | 15–25 percent | Funnel efficiency improvement |

Stability matters more than precision. Banner advertising compounds over time. Constant budget resets break that effect.

Budget changes should follow evidence, not instinct

Reallocation decisions should be driven by signal quality rather than short-term CPA swings. Indicators such as branded search lift, improved conversion rates in paid search, and reduced drop-off across the funnel are often better measures of banner effectiveness than attribution models alone.

Final takeaway

Banner advertising for fintech brands is not about clicks or quick wins. It is about systematic trust accumulation. Campaigns must be layered by user readiness, testing must focus on clarity and risk reduction, and budgets must reward learning quality over cheap reach.